But the more these families relied on capital gains to increase their wealth, the less able they were to pay off these loans in case of a downturn in stock prices.Īs well, the growing number of investment trusts made investing more accessible and attractive.

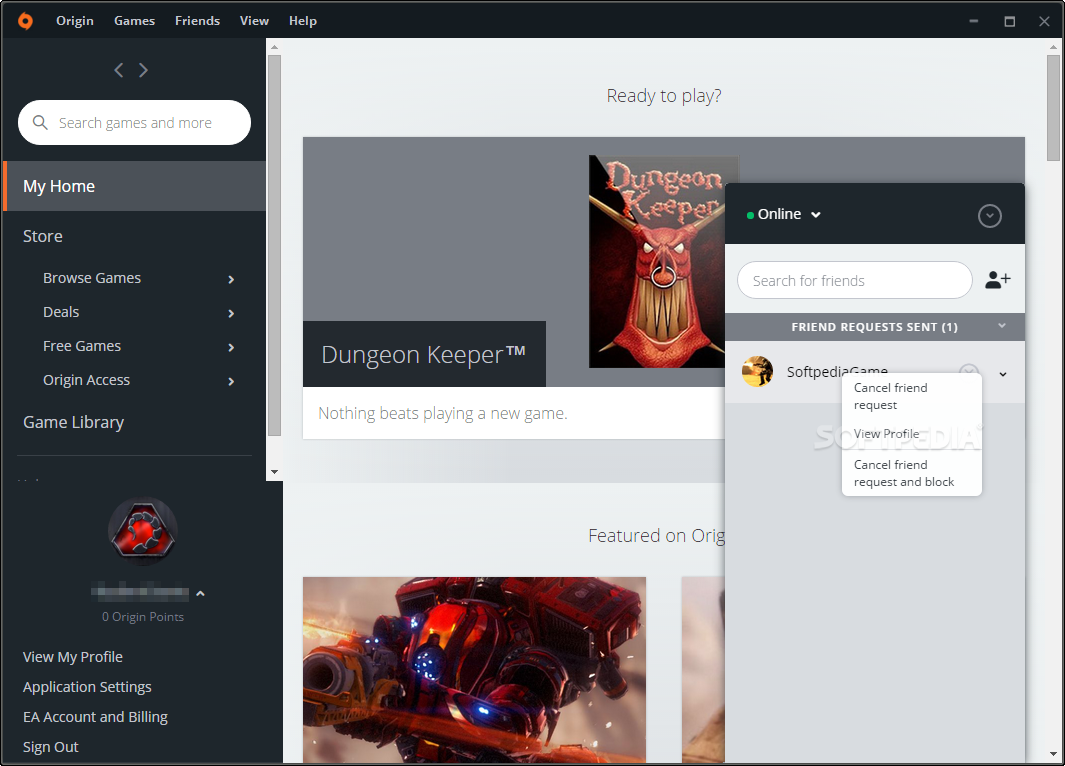

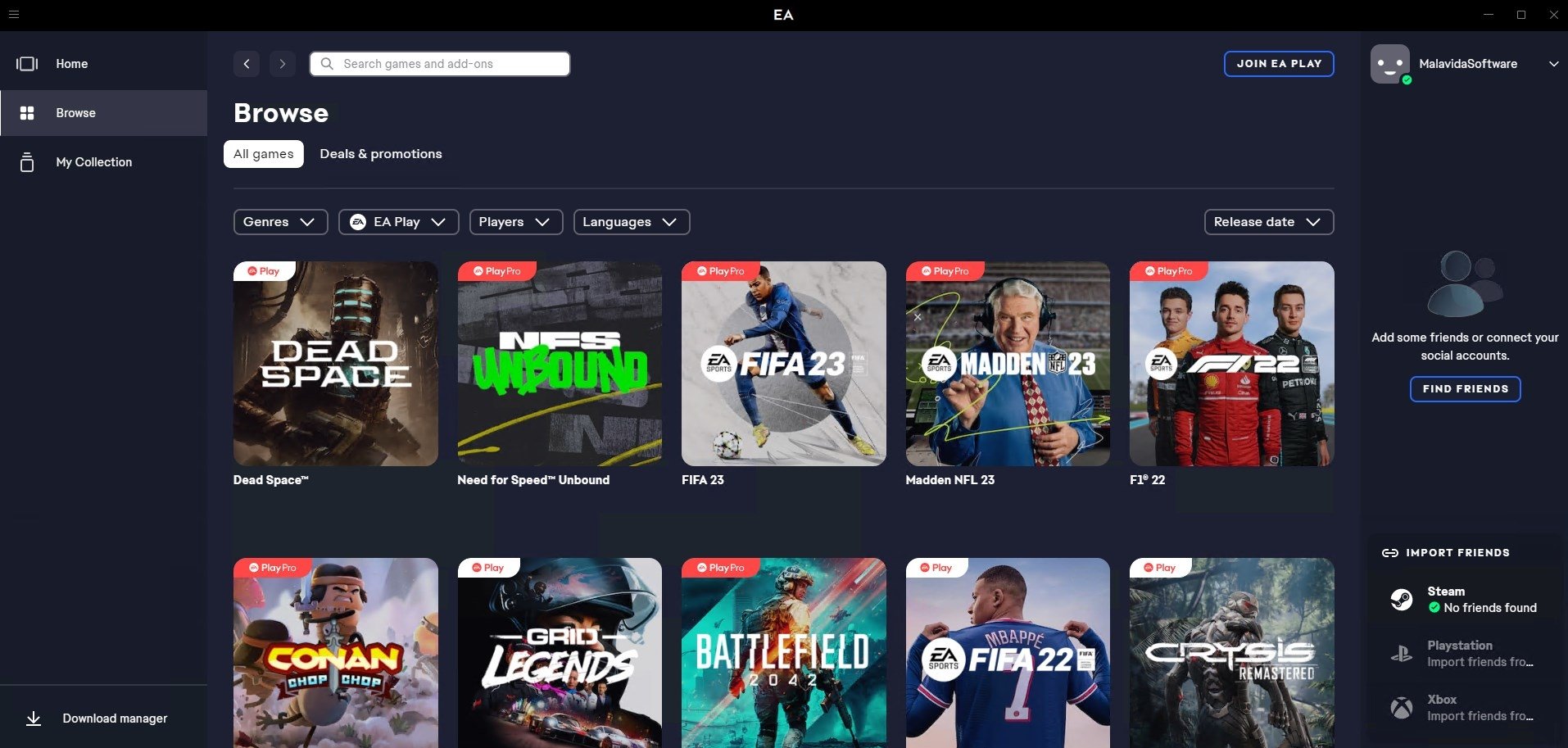

#GAMESTOP ORIGIN CLIENT PLUS#

Nearly 600,000 families were trading on margin, which means investing their own plus borrowed money. Rothbard, America’s Great Depression, Ludwig Von Mises Institute, 5th edition (June 15, 2000). In 1929, more than 1.5 million customers had accounts with America’s 29 stock exchanges.

Success stories of capital gains and speculation increased the number of individual traders. Certainly, stock traders and brokerage firms made their best efforts to encourage them. When an economic depression hit in 1920-21, people started looking for alternative ways of accumulating wealth and often chose to invest in stock markets.

Consumers not only felt the depreciation of the dollar in their pockets, but they could also read about it in newspapers and other publications. Starting in 1913, the inflation rate (the change in the Consumer Price Index) was calculated and published monthly. Then rising poverty and double-digit inflation provided motivation to put money into stock markets. However, most Americans invested in land and commodities, such as gold, until the early 20 th century. Trading was executed face-to-face and limited to this group of investors.Īfter Samuel Morse invented the telegraph in 1844, information was communicated remotely, which increased the number of potential investors. Today, that one-page “Buttonwood Agreement” (things were much simpler in those days) is considered the NYSE’s founding document and one of the most important financial records in American history. About 230 years ago, 24 brokers met under a buttonwood tree on Wall Street in New York City to make an agreement on the commission rates they would charge each other when trading Revolutionary War bonds and stocks from the First Bank of the United States. Originally, investing and brokerage firms were not meant for everyone. In so doing, Robinhood disrupted the century-old tradition of the minimum commission rule that, in 1894, the governing committee of the New York Stock Exchange (NYSE) called “the fundamental principle of the Exchange … on its strict adherence hangs the financial welfare and the life of the Institution itself.” Stephen Mihm, “The Death of Brokerage Fees Was 50 Years in the Making,” Financial Advisor, January 3, 2020, … Continue reading From Buttonwood to Vanguard This forced most brokerage firms to offer commission-free trading, which greatly increased public access to financial markets. Today, Robinhood has over 13 million customers, more than half of whom trade daily. Robinhood was the first to leverage digital technology for maximum accessibility with an app, enabling ordinary people to participate in our financial system from their smart phones. Not only were brokerage firms charging small investors $7 to $10 per trade, but they also required a deposit of $500 to $5,000 to open an account, which Robinhood waived. In 2013, they founded Robinhood to enable the little guys to invest in stock markets and trade other financial assets directly, without the wealth management industry making decisions for them-and without having to pay transaction fees. Tenev and Bhatt saw an opportunity to make their sophisticated software, which was powering large investment firms, available to retail consumers. Spencer White, “From Physics Grad Student to Financial Disruptor: Robinhood’s Vlad Tenev,, March 28, 2016, … Continue reading The duo “realized that big Wall Street firms paid effectively nothing to trade stocks, while most Americans were charged commission for every trade.”.

#GAMESTOP ORIGIN CLIENT SOFTWARE#

“edge funds and banks were using our software to place millions of transactions per day, and the portfolios they came up with were … incredibly rich,” said Tenev. For their second company, Chronos Research, Tenev and Bhatt created and marketed algorithmic trading software for automated transactions.

A year later, Tenev and Bhatt decided to start a trading company and moved to New York City.

In 2008, Tenev earned a bachelor’s degree in mathematics from Stanford University, and Bhatt, whom he met there, finished a master’s degree in mathematics. If, as above, we paraphrase Miranda’s words to her father, Prospero, in Shakespeare’s “The Tempest,” perhaps we would conjure the story of Vladislav Tenev and Baiju Bhatt, the founders of Robinhood Markets, Inc. “O wonder! How many ingenuous investors are there! How courageous mankind is! O brave new markets That has such retail investors in’t.” – The Tempest (of Markets)

0 kommentar(er)

0 kommentar(er)